The Risks and Opportunities of AI: A Policy Perspective

The explosive growth of ChatGPT can indeed be likened to an “iPhone moment” for artificial intelligence (AI), as NVIDIA CEO Jensen Huang observed. The commercialization of ChatGPT transitioned large language models from the confines of labs to real-world deployment. Many areas of AI have drawn significant attention from policymakers (Cao et al., 2023). AI’s near-term impact is estimated at $15.7 trillion.

Given the impacts and opportunities AI may bring, this essay attempts to delineate 1) the potential impact of AI and 2) policy recommendations for governments. We find that many sectors of AI have significant barriers to entry, increasing the risks of inequality in both macro and micro levels; at the same time, the opportunities of growth fueled by AI-driven innovation and productivity will serve as the future backbone of economic competitiveness for economies. This essay concludes that while the benefits of AI are indeed great, the risks are often overlooked–policymakers must take careful note of the risks of market concentration, 1) drafting regulations so as to actively encourage new entrants, thereby preventing excessively high market concentration, 2) encouraging investment in human capital and infrastructure such as public data centers, and 3) actively monitoring the industry for anti-competitive behavior and acquisitions.

The Risks: High Market Concentration and Increase in Inequality

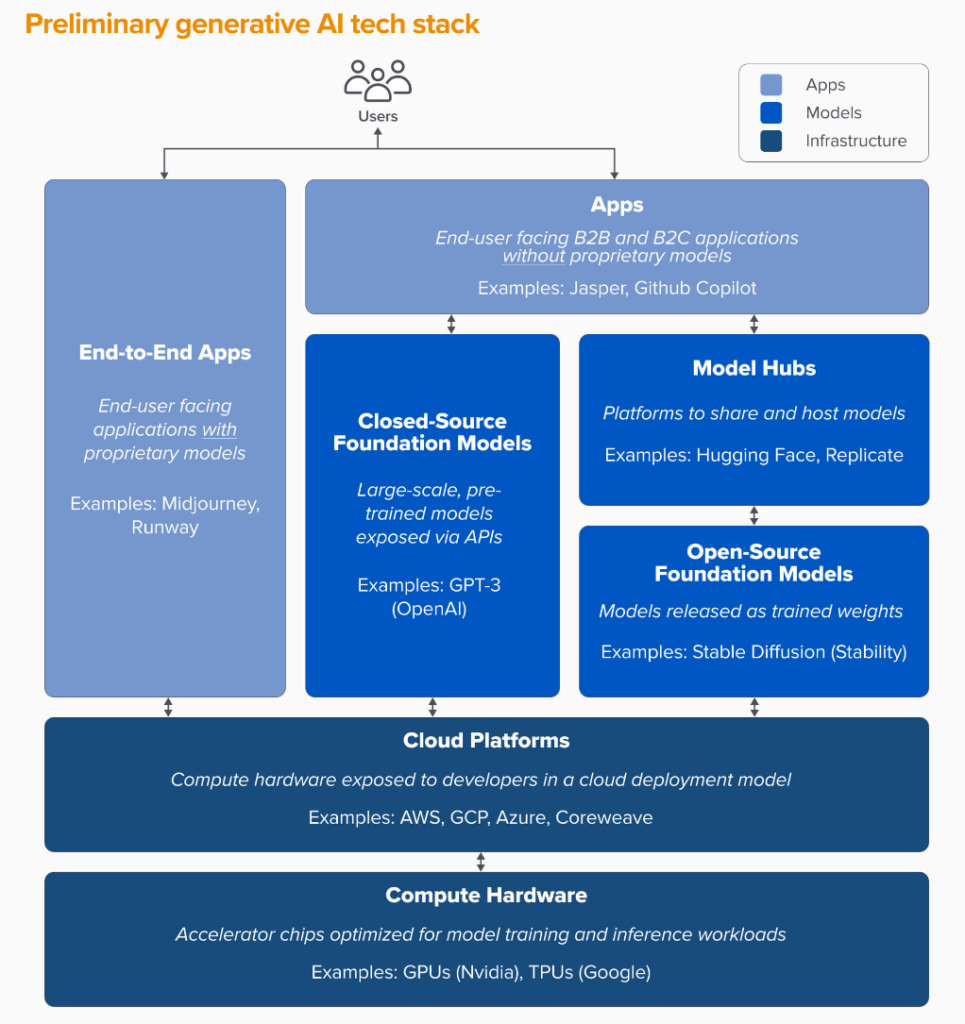

The AI industry supply chain includes many elements that require high capital and operating expenditures; we will mainly explore the compute infrastructure layer (data centers and chips) and foundational models.

Due to the high capital, operating, and switching costs related to data centers, the barrier to entry is very high. Microsoft and Meta have each acquired 150,000 of NVIDIA’s H100 GPUs, and the compute costs for OpenAI were estimated at $700,000 a day as of April 2023 (Mok, 2023; Shilov, 2023). It would be difficult for a new entrant to compete against this scale of investment. As shown in Fig 1, the barrier to entry allows incumbents to continue charging prices above marginal cost (P>MC), generating supernormal profits, decreasing consumer surplus, and generating deadweight loss to society.

Another critical part of the supply chain is the GPU. NVIDIA currently accounts for 85 percent of the GPU market (Rodzianko, 2023). NVIDIA has achieved massive economies of scale with its chip production, maintaining solid relationships with key suppliers. The company also has a firm hold of the AI development ecosystem with its wide spectrum of chips and a mature software stack. In a near-monopoly, the producer is able to charge a price that is above marginal cost levels, generating supernormal profits in the long term. As Fig 1 demonstrates, this results in decreased consumer surplus and a deadweight loss.

The third segment of concern is foundational models, such as GPT or LLaMA. The training, fine-tuning, and eventual inference of foundational models require human capital and operating expenditure that only “Big Tech” companies can manage (Narechania, 2022, p. 1543). The market for foundational models therefore is likely to develop into an oligopoly.

As shown, a large majority of the critical segments that make up the AI supply chain has a high barrier to entry. This can worsen inequality in two different domains. The first inequality would widen between companies that enjoy large supernormal profits and those that do not. This is because the enterprises that will develop AI applications based on the foundational APIs (i.e. ChatGPT-based applications) will likely take the form of a monopolistic competition, as was the case for application developers on the Apple or Google Play store (Etro, 2023). This leaves little room for API developers to innovate as they have little control and options over the price of foundational models they can build upon.

The second source of growing inequality may arise between developed and developing economies. It is likely that companies in the developed world (mainly the U.S.) will maintain their dominance in AI technology. This may result in a situation where nations excluding the U.S. are reliant on the U.S. for AI technology, leading to potential national security risks, elimination of domestic players, and monetary loss in private industries, widening global inequality (European Commission, 2020).

The Opportunity: Growth from Increased Productivity and Innovation

Despite the risks, AI offers once-in-a-generation scale growth opportunities for economies. Research has shown that AI can lead to an increase in workforce productivity by 25.1 percent (Dell’Acqua et al., 2023; Nurlia et al., 2023, p. 1). AI models like AlphaFold are currently in use by researchers, replacing costly and time-consuming methods, and AI image recognition technology also has potential to assist in radiology (Callaway, 2022, pp. 2, 4; Hosny et al., 2018). Accordingly, AI is expected to be used in diverse fields to assist in innovation and improve productivity. AI is expected to lead to a net growth in the economy given the potential of automation and by an increase in consumer demand for AI-related products (Gonzales, 2023). PwC (2017) forecasts a $15.7 trillion growth to the global economy.

The concern about AI replacing human workers is largely exaggerated, as job replacement is expected to be a temporary issue. An increase in productivity is unlikely to lead to a complete replacement of skilled, educated workers. Lou & Wu (2021) state that “AI innovation capability comes from employees possessing the combination of AI skills and domain expertise … as opposed to employees possessing AI skills only”. As such, while individual skilled employees are expected to produce more value, they are unlikely to be completely replaced. Still, this increase in productivity can lead to a decrease in the number of employees, displacing some skilled workers.

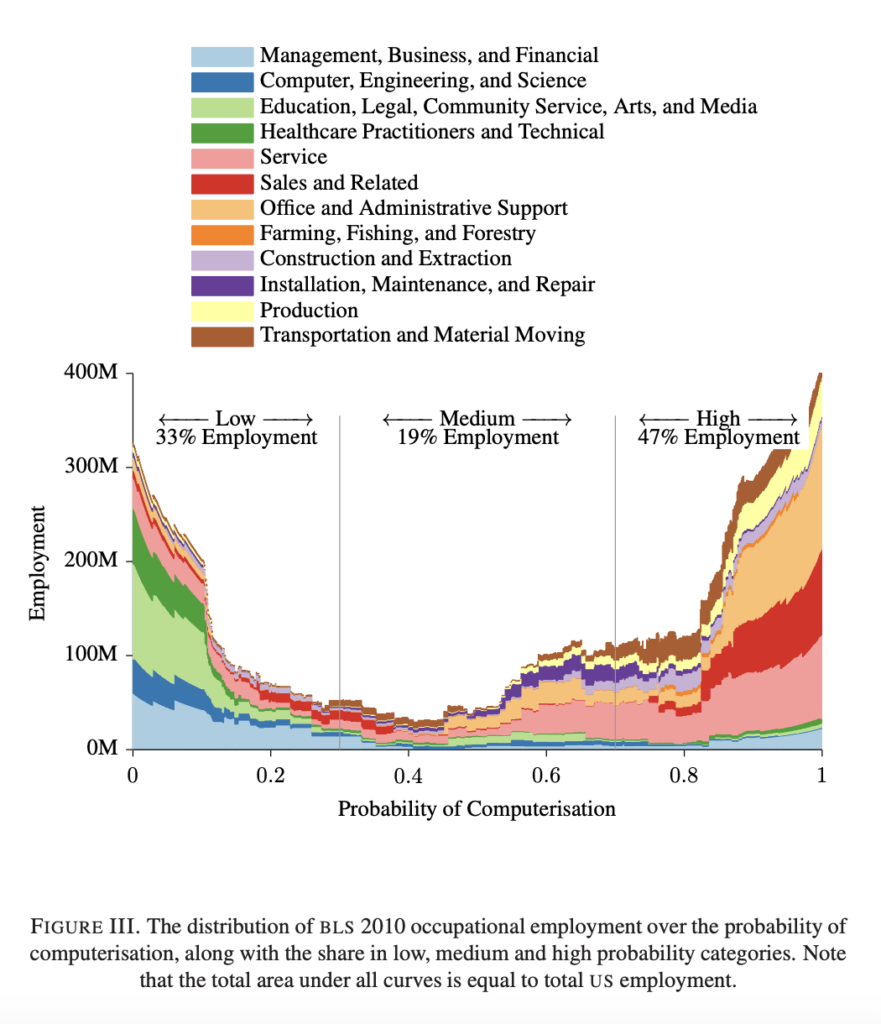

Nevertheless, unskilled workers are likely to be greatly impacted by AI technology at least in the short term (Aghion et al., 2019, p. 149). It is estimated that more than 80 percent of customer service will be performed by AI (Yarlagadda, 2017, p. 386; Autor, 2015). In fact, the majority of the high risk jobs most likely to be replaced by AI technology are the likes of service and office and administrative support jobs, while education and legal jobs, which require skilled workers, are mostly low risk, as can be seen in the figure below analyzing the labor market (Frey & Osborne, 2017). This trend may widen inequality in the short term.

AI can also lead to the creation of numerous new jobs (Wilson et al., 2017). For example, Tesla employs over 1,000 data labellers who label the likes of cars and pedestrians in driving footage to improve AI performance (Stecklow et al., 2023). In addition, the growth of AI-related markets will lead to an increase in employment, following Okun’s Law (Prachowny, 1993, p. 331). Average income is also expected to increase due to the implementation of AI (Goldfarb & Trefler, 2019, p. 463).

Policy Recommendations

The key challenge for policymakers would be to allow Big Tech companies to continue innovating, yet deterring anti-competitive behavior. They could do this by lowering the barrier to entry into the AI market for new entrants, through 1) building public computing infrastructure, 2) nurturing specialized human capital, and 3) actively regulating anti-competitive behavior.

Policymakers should actively support companies attempting to develop AI by providing the necessary infrastructure, such as a public AI data center or a public LLM. This will allow start-ups with innovative ideas but little capital to build their services on top of these public infrastructure. Governments can also grant subsidies or tax cuts to the research and development of AI or related technologies. The challenge would be to determine the amount of investment in public infrastructure, and the amount of benefits to provide to these companies. There are also those who argue that such policies will only act as “corporate welfare” without adequately fostering innovation (Goldfarb & Trefler, 2019, p. 464). Human capital is also crucial to successfully grow AI companies. Governments should establish policies to raise talent by subsidizing the education of AI scientists (Goldfarb & Trefler, 2019, p. 475). This can be done through subsidizing educational institutions and encouraging public-private partnerships.

Regulators also need to prevent anti-competitive behavior from Big Tech companies, as they are continuously expanding their scope of business, and attempting to achieve vertical integration in the AI supply chain. Not only are they acquiring start-ups that have built successful foundational models (e.g. OpenAI, Anthropic), but they are also developing in-house AI accelerators (e.g. Google TPU, Tesla Dojo). Unchecked, the market influence of Big Tech companies may become irreversible.

Further Considerations

Although not thoroughly dealt with in this work, policymakers also should consider the energy consumption and environmental impacts of AI (Bloomberg News, 2023; Dhar, 2020). Unchecked proliferation of AI may also reinforce existing economic inequality as AI models have been found to represent many societal biases due to the data sets they have been trained upon (Roselli et al., 2019).

References

Aghion, P., Antonin, C., & Bunel, S. (2019). Artificial Intelligence, Growth and Employment: The Role of Policy. Economie et Statistique / Economics and Statistics, 150-164. https://doi.org10.24187/ecostat.2019.510t.1994

Autor, D. H. (2015). Why Are There Still So Many Jobs? The History and Future of Workplace Automation. Journal of Economic Perspectives, 29(3), 3-30. https://www.aeaweb.org/articles?id=10.1257/jep.29.3.3

Bloomberg News. (2023, May 25). AI data-center boom will spur energy crisis. Bloomberg News. https://www.bloomberg.com/professional/blog/ai-data-center-boom-will-spur-energy-crisis/

Callaway, E. (2022, July 29). ‘The entire protein universe’: AI predicts shape of nearly every known protein. Nature.

Cao, Y., Li, S., Liu, Y., Yan, Z., Dai, Y., Yu, P. S., & Sun, L. (2023, March). A Comprehensive Survey of AI-Generated Content (AIGC): A History of Generative AI from GAN to ChatGPT. Research Gate. Retrieved January 4, 2024, from https://www.researchgate.net/publication/369090930_A_Comprehensive_Survey_of_AI-Generat ed_Content_AIGC_A_History_of_Generative_AI_from_GAN_to_ChatGPT

Dell’Acqua, F., McFowland, E., Mollick, E. R., Lifshitz-Assaf, H., Kellogg, K., Rajendran, S., Krayer, L., Candelon, F., & Lakhani, K. R. (2023). Navigating the Jagged Technological Frontier: Field Experimental Evidence of the Effects of AI on Knowledge Worker Productivity and Quality. Harvard Business School Technology & Operations Mgt. Unit Working Paper, 24(13). http://dx.doi.org/10.2139/ssrn.4573321

Dhar, P. (2020). The carbon impact of artificial intelligence. Nature Machine Intelligence, 2, 423-425. https://doi.org/10.1038/s42256-020-0219-9

European Commission. (2020, February 25). EU Foreign Technologies Dependency Crisis: Research Project Seeks Solutions and New Policies. CORDIS. Retrieved January 4, 2024, from https://cordis.europa.eu/article/id/413208-eu-foreign-technologies-dependency-crisis-research-pro

ject-seeks-solutions-and-new-policies

Etro, F. (2023). Platform competition with free entry of sellers. International Journal of Industrial

Organization, 89, 102903. https://doi.org/10.1016/j.ijindorg.2022.102903

Frey, C. B., & Osborne, M. A. (2017). The future of employment: How susceptible are jobs to

computerisation? Technological Forecasting and Social Change, 114, 254-280.

https://doi.org/10.1016/j.techfore.2016.08.019

Goldfarb, A., & Trefler, D. (2019). Artificial Intelligence and International Trade. In A. Agrawal & J.

Gans (Eds.), The Economics of Artificial Intelligence: An Agenda (pp. 463-492). University of

Chicago Press. http://www.nber.org/chapters/c14012

Gonzales, J. T. (2023). Implications of AI innovation on economic growth: a panel data study. Journal of

Economic Structures, 12. https://doi.org/10.1186/s40008-023-00307-w

Hosny, A., Parmar, C., Quackenbush, J., Schwartz, L. H., & Aerts, H. J. (2018). Artificial intelligence in

radiology. Nature Reviews Cancer, 18, 500-510. https://doi.org/10.1038/s41568-018-0016-5 Lou, B., & Wu, L. (2021). AI on Drugs: Can Artificial Intelligence Accelerate Drug Development?

Evidence from a Large-scale Examination of Bio-pharma Firms,. MISQ Forthcoming.

http://dx.doi.org/10.2139/ssrn.3524985

Bornstein, M., Appenzeller, G., & Casado, M. (2023, September 3). Who owns the Generative AI

platform?. Andreessen Horowitz. https://a16z.com/who-owns-the-generative-ai-platform/

Mok, A. (2023, April 20). ChatGPT could cost over $700,000 per day to operate. Microsoft is reportedly

trying to make it cheaper. Business Insider.

https://www.businessinsider.com/how-much-chatgpt-costs-openai-to-run-estimate-report-2023-4 Narechania, T. N. (2022). Machine Learning as Natural Monopoly. Iowa Law Review, 107(4), 1543.

http://dx.doi.org/10.2139/ssrn.3810366

Nurlia, N., Daud, I., & Rosadi, M. E. (2023). AI Implementation Impact on Workforce Productivity : The Role of AI Training and Organizational Adaptation. Economics and Business Journal, 1(1), 1-13. https://doi.org/10.61536/escalate.v1i01.6

Ozturk, I. (2007). Foreign Direct Investment – Growth Nexus: A Review of the Recent Literature. International Journal of Applied Econometrics and Quantitative Studies, 4(2), 79-98. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1127314

Pires, F. (2023, August 17). NVIDIA Makes 1,000% Profit on H100 GPUs: Report. Tom’s Hardware. https://finance.yahoo.com/news/nvidia-makes-1-000-profit-145130987.html

Prachowny, M. F. (1993). Okun’s Law: Theoretical Foundations and Revised Estimates. The Review of Economics and Statistics, 75(2), 331-336. https://doi.org/10.2307/2109440

PwC. (2017). Sizing the prize: What’s the real value of AI for your business and how can you capitalise? PwC. Retrieved January 4, 2024, from https://www.pwc.com/gx/en/issues/analytics/assets/pwc-ai-analysis-sizing-the-prize-report.pdf

Rodzianko, O. (2023, November 29). Up close to 300%! Will NVIDIA stock keep on climbing? The Motley Fool.

https://uk.finance.yahoo.com/news/close-300-nvidia-stock-keep-095852613.html?guccounter=1& guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAMehZs2s L_W6Rl3GH2xWydTgTQyggC45adEPNK0RNadogn809g692KE8yl-0WuJ31BWJ4TYHtY35V kdr7-Nlna10FiTXpyIOYw

Roselli, D., Matthews, J., & Talaga, N. (2019). Managing Bias in AI. Companion Proceedings of The 2019 World Wide Web Conference, 539-544. https://doi.org/10.1145/3308560.3317590

Roser, M. (2022, December 6). The brief history of artificial intelligence: The world has changed fast – what might be next? Our World in Data. https://ourworldindata.org/brief-history-of-ai?fbclid=IwAR0D3CcO9eq6YPHSqgGjhh8lppr3AV V3IjBmgwoIjPMcmlqprlMODWtRDPA#article-citation

Semmler, W. (1982). Theories of competition and monopoly. Capital & Class, 6(3), 91-116. https://doi.org/10.1177/030981688201800106

Shilov, A. (2023, November 28). NVIDIA sold half a million H100 AI GPUs in Q3 thanks to Meta, Facebook — lead times stretch up to 52 weeks: Report. Tom’s Hardware. https://finance.yahoo.com/news/nvidia-sold-half-million-h100-001055544.html?guccounter=1&g uce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAMehZs2sL _W6Rl3GH2xWydTgTQyggC45adEPNK0RNadogn809g692KE8yl-0WuJ31BWJ4TYHtY35Vkd r7-Nlna10FiTXpyIOYw6

Sohn, D.-J. (2023, June 26). Korea is all hands on deck for AI chip race. Korea JoongAng Daily. https://koreajoongangdaily.joins.com/2023/06/26/business/industry/KCloud-Project-cloud-semico nductor/20230626153808109.html

Stecklow, S., Cunningham, W., & Jin, H. (2023, April 7). Tesla workers shared sensitive images recorded by customer cars. Reuters. https://www.reuters.com/technology/tesla-workers-shared-sensitive-images-recorded-by-custome

r-cars-2023-04-06/

UKRI. (2023, November 1). £300 million to launch first phase of new AI Research Resource. UKRI.

Retrieved January 4, 2024, from

https://www.ukri.org/news/300-million-to-launch-first-phase-of-new-ai-research-resource/ Wilson, J., Daugherty, P. R., & Morini, N. (2017, March 23). The Jobs That Artificial Intelligence Will

Create. MIT Sloan Management Review. Retrieved January 4, 2024, from

https://sloanreview.mit.edu/article/will-ai-create-as-many-jobs-as-it-eliminates/

Yarlagadda, R. T. (2017). AI Automation and It’s Future in the UnitedStates. International Journal of

Creative Research Thoughts, 5(1), 382-389. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3798873

This article was originally written as a submission to HIEEC 2023-2024 and was awarded the Highly Commended distinction.

This is one of the most informative posts I’ve read on this topic. Your clear explanations and real-life examples are incredibly helpful.